We are honored to be a part of Luxury Portfolio International’s newest report on high-end residential auctions, taking a deep dive into the popularity of luxury real estate auctions and the differentiators from traditional selling. The study brings together analysis and first-hand input from a variety of property specialists worldwide, including Concierge Auctions from the U.S., Barfoot & Thompson from New Zealand, and Belle Property from Australia.

An auction, a public sale where a good or property is sold to the highest bidder, is one of the oldest ways of selling the world over. The great auction houses of Europe have been selling valuable fine art, jewelry, real

estate and collectibles in Europe since the mid-1700s through this form of sale. While grand estates of England were the main type of real estate sold at auction in the United Kingdom in centuries past, this has transitioned to a wide range of residential property in recent decades. The auctioning of real estate was introduced in the U.S. around the turn of the 20th century. Land and ranches were auctioned from this period, according to Concierge Auctions, a U.S.-based high-end property auction firm which works with luxury agents to sell their properties via auction in over 20 countries from France, the U.K., Israel and the U.S. Most of the Concierge Auctions’ sales are conducted from its online platform or app, vs. a live “in-person” event, enabling buyers to pre-register and bid from anywhere. But the part of the world where auctioning homes has really taken hold is in Australia and New Zealand. In Australia, it has been popular for the past 60 years or more. Meanwhile, in New Zealand, this method of sale was initially adopted by main real estate brokerages in the 1980s. Peter Thompson, managing director of New Zealand brokerage Barfoot & Thompson reasoned that the buying and selling of cattle was historically done by auction, while car auctions were also popular, so why not real estate? In the early days in New Zealand, the homes that were auctioned were those that were considered a bit “different” or were difficult to price. “At auction it allowed buyers to price them. But once the market got going, it went across all spectrums,” says Thompson. In a peak market, such as the recent one from 2013 to 2016, as much as 80 percent of Barfoot & Thompson’s real estate listings were sold by live auction. “Selling real estate by auction is most widespread in Australia. The auction of livestock was the custom in the country towns, and this was brought to the cities by the big farming families,” says Belle Property Head of Sales and Business Development, Nick Boyd. Currently, in New South Wales and Victoria, home to Sydney and Melbourne, he estimates up to 70 percent of home sales are sold by live auction. “Auction has become the heartbeat of real estate in Australia,” he says. People attend these sales to gauge the health of the property market.

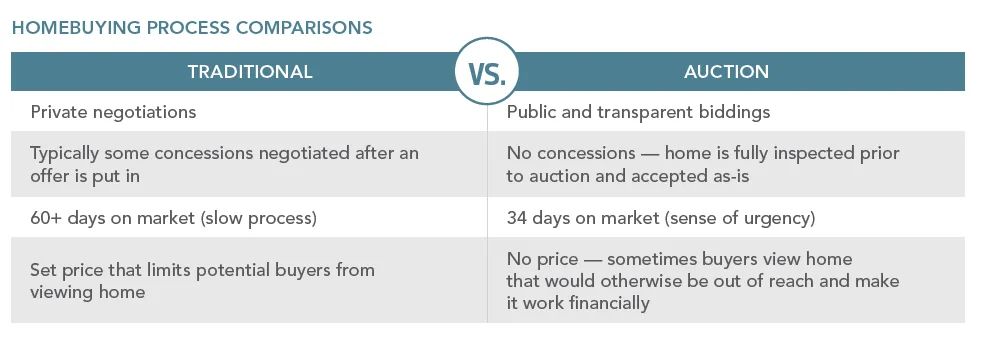

Auctions, whether live or online, are run by an auctioneer working on behalf of the selling agent. When a homeowner decides to sell by auction, they are showing that they are serious about their desire to sell. Auctions differ from the traditional homebuying process in that there is no negotiating after the hammer falls. The interested parties who register for the auction have done all their due diligence and inspections prior to the auction and the winning bid is final and unconditional. “In a traditional sale, by contrast, the negotiating has only just begun when an offer is accepted, more concessions are often asked for subsequently,” says Laura Brady, CEO of Concierge Auctions. Auctions also differ from the traditional real estate buying experience in that they are transparent, public events where you can see the other buyers and what they are willing to pay, says Barfoot & Thompson auction manager, Campbell Dunoon. “What the auction does is take away price,” says Dunoon. Without an asking price, a buyer might go and see a property, fall in love with it and try to make it work financially, whereas a lofty asking price might stop them from even viewing the property. Boyd says when educating the buyer he tells them if they love the property, they should have three prices in mind; one where they would be ecstatic if they bought at that price, a second price where it would be a fair market price, and a “if I had to” price. “There is an openness and a fairness to auctions, that you don’t get with traditional selling,” points out Dunoon.

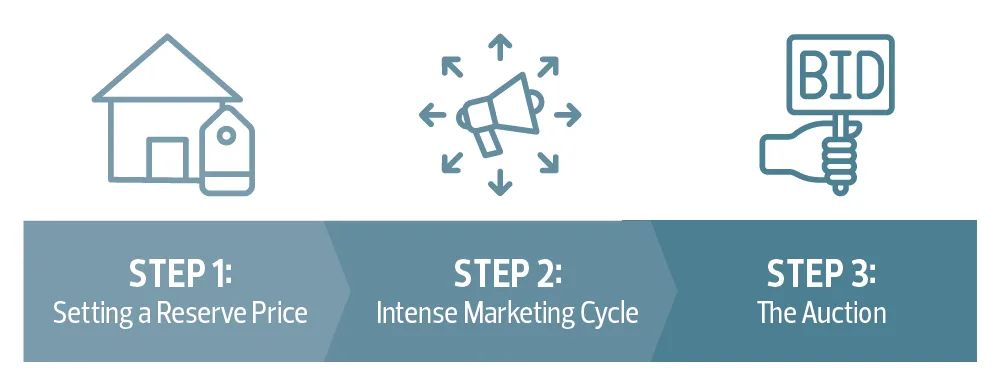

Three distinct steps exist in the auction process. Sellers first determine whether they will set a reserve price prior to auction, which is then followed by an intense marketing cycle. Finally, the auction is held in a public setting, either in-person or online.

STEP 1: Setting a Reserve Price

In New Zealand and Australia, a reserve price is set at which the seller would be happy selling their home. Sellers hope to sell for more than the reserve price but this gives them a comfort level that their home will not sell at a bargain price. If the reserve price is not reached at auction, the property is “passed in” and the selling agent will negotiate with the highest bidders from the auction in the days immediately after. This usually results in a successful sale. By contrast, most luxury properties from Concierge Auctions are sold without a reserve — the home is sold to the highest bidder regardless of price. If there is a reserve price on a Concierge Auctions property and it is not reached, and bidders are still interested in acquiring the property, the bidder will reach out to the seller and their agent directly to negotiate a deal.

STEP 2: Intense Marketing Cycle

Notably, there is a high-profile marketing period in the run up to an auction that lasts between four and six weeks. Concierge Auctions, for example, holds open houses — typically daily — during the entire exposure period. In New Zealand and Australia, open houses are typically reserved for the weekend, where they’ll gather market feedback on what the home is likely to sell for. In addition to the frequent open houses, in New Zealand, Thompson says selling agents might put large advertisements in the newspaper at the beginning of an auction campaign. Meanwhile, Concierge Auctions and Belle Property host social events to showcase their premier properties and draw interest. “It’s more about the process rather than the spectacle of a party in Australia,” says Boyd.

STEP 3: The Auction

A Belle Property auction at the property is a sight to see, as it is often held on the front steps or in the living room of the property for sale. The neighbors come to see what they could get for their property, friends of the vendors (aka sellers) might be there, friends of buyers wanting support, it’s a real neighborhood event. Meanwhile, not all auctions are alike. Real estate firms can manage the auction to cater to their ultraluxury clients. For its high-net-worth individuals, Belle Property runs private auctions at the property, where only registered buyers can attend and bid and the public is not allowed. It gives anonymity to this exclusive clientele, which they appreciate.

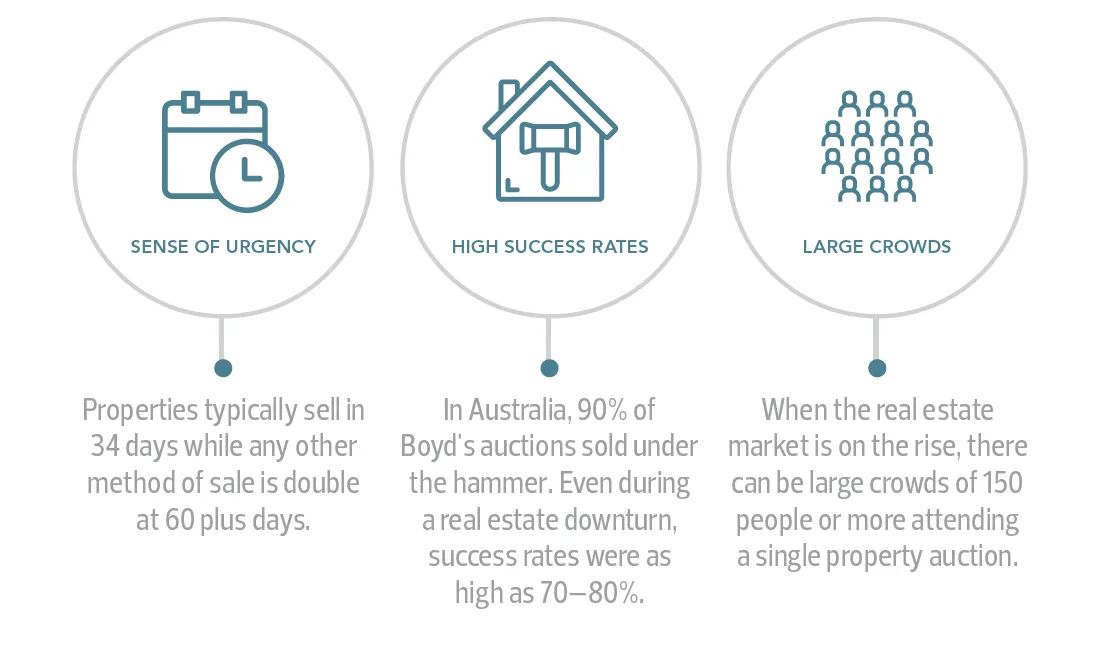

Auction is a popular option in New Zealand and Australia for properties of all price levels. Public awareness and adoption of the auction model is high in both countries as sellers are happy to consider an auction sale and buyers are not afraid of the auction process. The numbers say it all. The sense of urgency around an auction means that properties typically sell in 34 days while any other method of sale is double at 60 plus, says Boyd. The success rate of auctions is also notably high. For Boyd, 90 percent of his auctions sold under the hammer recently, and even during a recent real estate downturn in Australia, rates were still as high as 70 to 80 percent. At six auctions held on one Saturday in 2019, Boyd, who does around 400 auctions per year, reported an attendance of 400 to 500 people. Many were there because they wanted to see what the market was doing. When the market is on the rise, there can be huge crowds at the auction of a property. In Australia, there are more on-site auctions than those held in auction rooms. It’s not unusual to see 150 people attend a single auction at the property, says Boyd. In New Zealand, auctions are more often held in the rooms of the real estate brokerage than at the property. In the case of Barfoot & Thompson, two-thirds of property auctions are held in the rooms, one-third at the property. Holding the auction at the brokerage’s rooms brings out the serious buyers and lowers the incidence of distractions, says Thompson.

Auctions provide certainty on both sides of a transaction, for many reasons. In the days approaching the auction, the bidders must have registered their interest and completed all the inspections, so the selling agent has a list of registered, interested parties on the day of the auction. In order to bid at auction, there is an expectation that the buyer must have their finances in order because the contract is unconditional. In Australia, for example, as soon as the hammer falls the property is sold and a 10 percent deposit is to be paid immediately by check or transfer. Boyd says: “If they buy at auction, the buyer is 100 percent liable to pay.” In New Zealand and Australia, the seller sets the reserve price, so they are in control, the house will not sell at auction below the reserve price they have set. The home will only “come on the market” officially during the auction if the reserve price is reached. Even in slower markets, auctions still lead people to make a decision, says Thompson. If the property doesn’t sell at auction, you still have “a willing buyer and seller” on site, he says. Importantly, the days on market will be far more certain, says Brady. For high-end properties with a smaller pool of buyers, this is especially a concern, she says, as there is an inherent cost to accumulated days on market. In 2018, looking at the top 10 properties in 56 markets across the U.S., Concierge Auctions found 62 percent of luxury properties took more than six months to sell, while 23 percent took more than two years to sell. In contrast, Brady, whose company works with a number of agents in luxury brokerages, says its auctions have a success rate of 75 percent of homes selling after just four to six weeks of marketing. “Selling the traditional way by putting a price on a property and waiting for buyers to bite, can be very inefficient and there can be a lack of control,” says Brady. In a world where people are used to immediate gratification, real estate has not been following that trend, she says

Most traditional real estate activity rapidly moved to better leverage online with the onset of COVID-19. In markets where real estate was deemed essential, in-person tours have been held by appointment with a limited number of people allowed to view the property at a time. In markets like New Zealand, where quarantine ordinances were significantly stricter, all in-person activities came to a complete, temporary halt, but Thompson anticipated pent-up demand as the country slowly reopens. Belle Property reports, prior to the pandemic, these open houses would attract an average of 80 groups of people per cycle. Because of the restrictions on the number of people allowed to view a property at a time, agents quickly began putting in work “behind-thescenes” to vet that buyers are both genuinely interested and qualified before viewing. Accordingly, Boyd reported seeing the pool of inspecting buyers shrink to 10 people during the same marketing cycle. Additionally, both Barfoot & Thompson and Belle Property rapidly adapted by bringing the auctions themselves online. In New Zealand, auctions are now livestreamed and bids are placed via mobile app or PC. This change is taking some time for agents and buyers to embrace, with Belle Property reporting a reduction in auction sales volume in favor of treating the auction date as a deadline to put in an offer. As buyers become more accustomed to these new practices, however, the turnout may become quite positive. Barfoot & Thompson recently explained its new online selling technology in a webinar that attracted over 700 viewers. In fact, Thompson predicts that the improved accessibility and convenience of auctions may contribute to an even greater adoption of this salesmethod over time. As Concierge Auctions’ transactions were already largely conducted online, this part of the process was minimally interrupted. However, much of the in-person marketing activities have been shifted to the internet, with daily virtual open houses during dedicated windows of time, as well as pre-recorded viewings and 3D tours. Ultimately, there are many benefits and efficiencies that can be gleaned from the auction process and how it has been successfully implemented around the world. In a post-COVID real estate world, it may just be something that will gain more traction as the real estate industry, all its ancillary services, and consumers more rapidly embrace change and new ways of doing things in the modern real estate transaction.

To view the full Luxury Portfolio International Special Report, visit luxuryportfolio.com/whitepaper.